The global technology landscape has officially entered a new era — Nvidia is now a $5 trillion company, the first in history to achieve this milestone. Powered by soaring demand for its artificial intelligence (AI) chips and strategic investments across the tech ecosystem, Nvidia has become the world’s most valuable company, reshaping modern computing and investor sentiment alike.

How Nvidia Achieved the $5 Trillion Milestone

Nvidia’s market valuation crossed the $5 trillion threshold at Wednesday’s market open, with shares climbing nearly 3% and year-to-date gains reaching 50% in 2025. What makes this achievement remarkable is its pace — the company took just 13 months to move from $3 trillion to $4 trillion, and only three months later, it shattered the $5 trillion mark.

This rapid rise is driven primarily by unprecedented demand for AI hardware. Nvidia’s GPUs (graphic processing units) have become the foundation of AI infrastructure globally — powering cloud computing, autonomous systems, robotics, and generative AI applications.

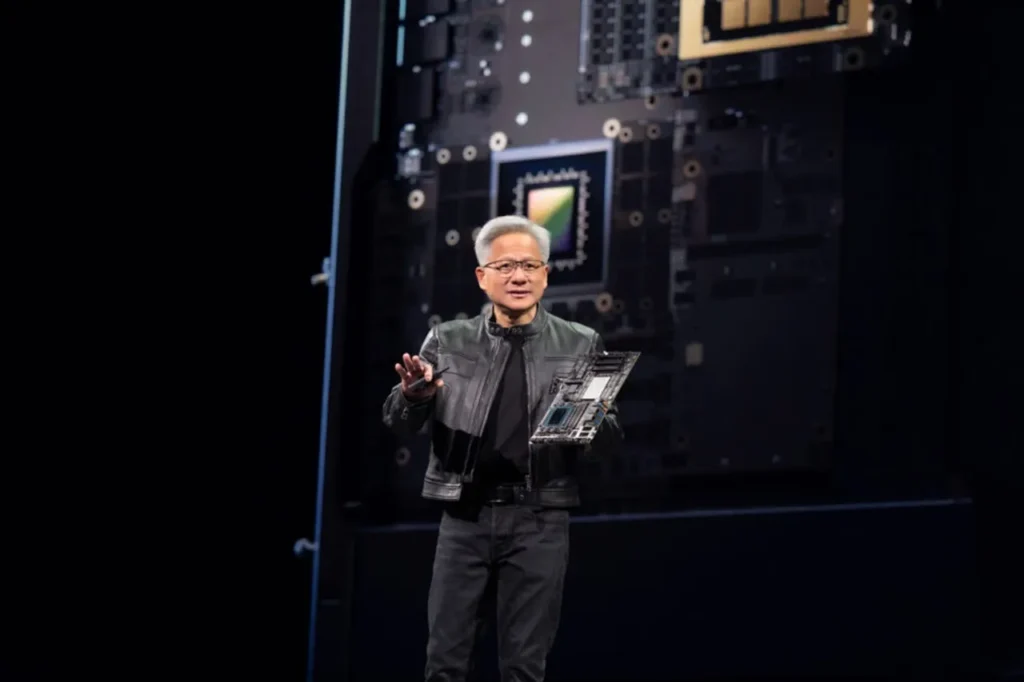

Jensen Huang’s Vision and Leadership

At the company’s GTC AI Conference in Washington, Nvidia CEO Jensen Huang presented an ambitious roadmap for the future of computing. He emphasized a world where Nvidia chips will power cell towers, self-driving vehicles, and industrial robotics, making AI accessible across every sector.

Huang’s vision, coupled with optimism around potential US-China tech discussions under Presidents Donald Trump and Xi Jinping, has further boosted investor confidence. His leadership continues to be one of Nvidia’s strongest assets, steering the company through the volatile yet promising AI era.

Nvidia vs. Apple: A Shift in Market Power

Nvidia’s success story comes just as Apple reached the $4 trillion valuation mark, showcasing a symbolic shift in market leadership from consumer technology to AI-driven innovation.

| Company | Market Valuation (Oct 2025) | Year-to-Date Stock Growth | Core Strength |

|---|---|---|---|

| Nvidia | $5 Trillion | +50% | AI Chips & Data Infrastructure |

| Apple | $4 Trillion | +25% | Consumer Electronics & Ecosystem |

| Intel | $300 Billion | +8% | Semiconductor Manufacturing |

While Apple remains the cornerstone of consumer tech, Nvidia’s AI-first business model positions it as the leader of the next industrial transformation.

Strategic Partnerships and Long-Term Investments

Nvidia’s growth trajectory is supported by strategic alliances that reinforce its dominance in the AI landscape. Recently, the company announced a $100 billion partnership with OpenAI, where ChatGPT’s parent company will purchase billions of dollars in Nvidia chips.

In addition, Nvidia confirmed a $5 billion investment in Intel, signaling confidence in the broader semiconductor ecosystem. These moves not only diversify Nvidia’s portfolio but also secure its leadership in AI infrastructure and chip innovation.

Addressing Market Concerns

Despite the optimism, analysts have voiced concerns about potential overheating in the AI sector. The rapid cycle of investment and reinvestment among AI companies has led some to question whether the industry could face a correction.

However, Nvidia’s fundamentals remain solid. The company reported nearly $26 billion in net income in its most recent quarter, backed by a forecast of $4 trillion in global AI infrastructure spending by the end of the decade. This financial strength underscores that Nvidia’s valuation is supported by real growth, not speculation.

Looking Ahead: Nvidia and the Future of AI

Nvidia’s $5 trillion valuation represents more than market momentum — it reflects the world’s accelerating reliance on AI computing. As industries integrate AI into every layer of operation, Nvidia’s hardware and software ecosystem will continue to serve as the engine driving digital transformation.

From data centers to robotics and autonomous vehicles, Nvidia isn’t just building chips — it’s building the infrastructure for the future of intelligence.